Insights on credit score optimization for better loans

Your credit score significantly influences loan approval rates, with higher scores increasing the likelihood of approval and better interest rates from lenders.

Insights on credit score optimization can make a significant difference in your financial life. Have you ever wondered how your credit score impacts your ability to secure loans? Let’s dive into how enhancing your score can open doors to better financial opportunities.

Understanding credit scores and their importance

Understanding credit scores is essential for anyone looking to manage their finances effectively. A credit score is a three-digit number that represents your creditworthiness. It reflects how likely you are to repay debts, influencing lenders when they decide whether to approve loans.

A strong credit score can lead to better interest rates and financial opportunities. On the other hand, a low score can make borrowing more expensive or even impossible. Credit scores impact various financial aspects, from mortgages to credit cards and beyond.

Components of a Credit Score

Your credit score is calculated using several key factors. Each plays a role in shaping your score.

- Payment history: This is the most significant factor, making up about 35% of your score. Timely payments positively impact your score, while late payments hurt it.

- Credit utilization: Your credit utilization ratio measures how much credit you’re using versus your total credit limit. Ideally, keep this below 30% for a healthy score.

- Length of credit history: A longer credit history can enhance your score, reflecting your experience in managing credit.

- Types of credit: Having a mix of credit types, such as credit cards, installment loans, and lines of credit, can be beneficial.

Building and maintaining a healthy credit score is a gradual process that requires attention and strategy. Regularly checking your credit report can help you understand where you stand. By monitoring your credit, you can spot errors or fraudulent activity that might negatively affect your score.

Furthermore, it’s crucial to limit hard inquiries on your credit report. Applying for too many loans in a short period can lower your score. Instead, focus on establishing responsible financial habits, like paying bills on time and managing existing debt.

Common myths about credit scores debunked

Many people hold myths about credit scores that can affect their financial decisions. It’s important to separate fact from fiction to make informed choices. Understanding the truth can empower you to improve your credit score effectively.

Myth 1: Checking your credit score hurts it

One common misconception is that checking your own credit score will lower it. In reality, this is not true. When you check your own credit score, it is considered a “soft inquiry.” Soft inquiries do not impact your score at all.

Myth 2: Closing old accounts boosts your score

Many believe that closing old or unused credit accounts will enhance their credit score. However, this can actually hurt your score. Keeping older accounts open helps with the length of your credit history, which is beneficial for your credit score.

- Old accounts show credit history: They can demonstrate your reliability as a borrower.

- Impact on credit utilization: Closing accounts can increase your overall credit utilization ratio.

- Keep terms open: Rather than closing them, consider using them occasionally to keep them active.

Myth 3: Paying off debt eliminates all credit issues

It is a common belief that paying off all debt automatically fixes credit issues. While reducing debt is a major positive step, it doesn’t immediately remove negative marks from your credit report. Late payments or defaults can linger on your credit report for several years.

Thus, it’s critical to develop a comprehensive strategy for managing your credit. This includes timely payments and responsible credit use, rather than relying solely on debt reduction. Monitoring your credit report regularly can help you stay aware of what’s impacting your score.

By understanding these myths and replacing them with facts, you can take actionable steps towards improving your credit score.

Practical tips for optimizing your credit score

Improving your credit score can seem daunting, but it doesn’t have to be. There are several practical tips you can implement that can lead to significant improvements over time. Small changes can make a big difference in how lenders view your creditworthiness.

Regularly Check Your Credit Report

One of the best ways to optimize your credit score is to check your credit report regularly. You can obtain a free credit report annually from each of the major credit bureaus. Look for inaccuracies or errors that could lower your score.

- Identify errors: Fix wrong information that may negatively impact your score.

- Monitor your accounts: Keep track of any changes or new accounts that appear.

- Dispute inaccuracies: If you find incorrect information, dispute it with the credit bureau.

Pay Your Bills on Time

Your payment history is the most significant factor in your credit score, accounting for about 35% of the total. Paying bills on time each month can positively influence your score. Set up reminders or automate payments to ensure they are never late.

Additionally, consider making payments for loans and credit cards week by week, instead of monthly. This approach can help you manage your cash flow better while showing lenders that you are responsible.

Keep Credit Utilization Low

Credit utilization refers to how much credit you’re using compared to your total available credit. Aim to keep this percentage below 30%. If you find that you’re using too much of your available credit, consider paying down balances or asking for a credit limit increase.

Remember that utilizing too much credit can signal to lenders that you may be over-leveraged and could lead to a negative impact on your score.

Limit New Credit Applications

Each time you apply for new credit, it results in a hard inquiry on your credit report. While a couple of inquiries won’t drastically change your score, too many in a short period can be harmful. Limit the number of credit applications you make.

Instead, focus on specific needs and only apply when necessary. This will help keep your credit score safer while you build your financial history.

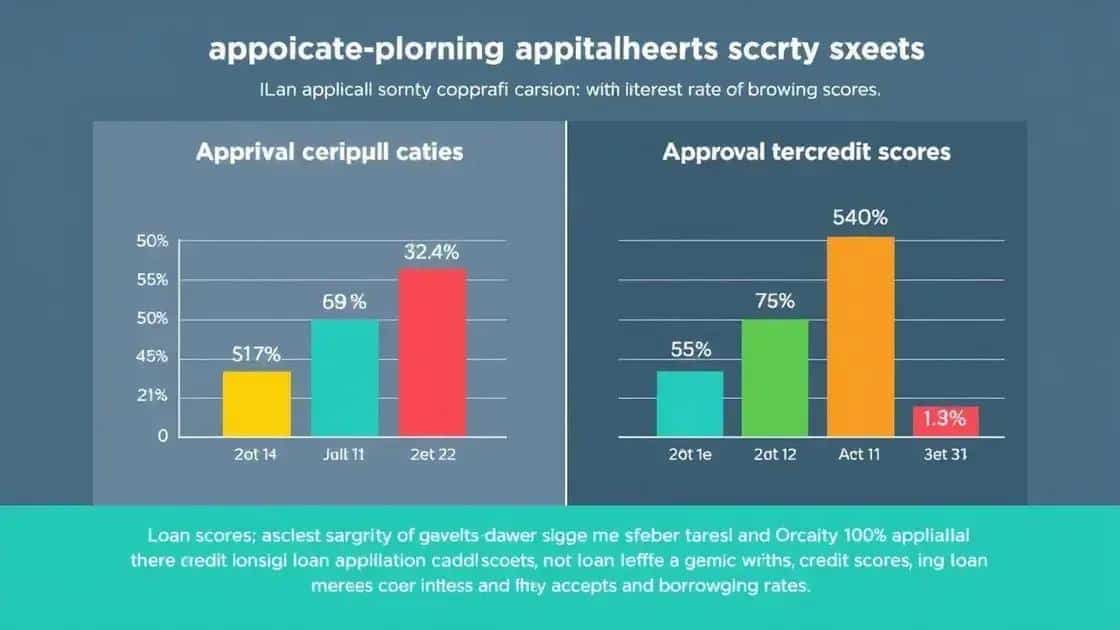

How credit scores affect loan approval rates

Your credit score plays a crucial role in determining your loan approval rates. When you apply for a loan, lenders evaluate your creditworthiness based on this score. A higher score can significantly improve your chances of being approved for loans.

Understanding Loan Approval

When assessing loan applications, lenders consider several factors, with credit score being a primary one. A robust credit score indicates a history of responsible borrowing and timely payments, making you a lower risk for lenders.

- Higher approval rates: Individuals with scores above 700 are often approved more easily.

- Interest rates: Better credit scores also lead to more favorable interest rates.

- Loan amounts: A strong score may qualify you for higher loan amounts.

Impact of Low Credit Scores

If your credit score is below 650, you might face considerable challenges in obtaining a loan. Many lenders may deny your application or offer loans at much higher interest rates to offset the risk.

Low credit scores can suggest to lenders that you may have difficulty managing debt. This perception can lead to increased scrutiny during the approval process.

Improving Your Chances

To enhance your chances of loan approval, it’s beneficial to focus on improving your credit score before applying. This means paying off outstanding debts and ensuring all your bills are paid on time.

Additionally, regularly checking your credit report for inaccuracies helps ensure that your score reflects your true financial habits. By taking proactive steps to manage your credit, you can create a more favorable impression on lenders.

FAQ – Frequently Asked Questions about Credit Scores

How does my credit score affect loan approval?

Your credit score is a key factor in determining whether you will be approved for a loan. A higher score increases your chances of approval and can lead to better interest rates.

What can I do to improve my credit score?

To improve your credit score, pay your bills on time, keep your credit utilization low, and check your credit report for errors regularly.

Will checking my credit score lower it?

No, checking your own credit score is considered a soft inquiry, which does not affect your credit score at all.

How often should I check my credit report?

It’s a good practice to check your credit report at least once a year to ensure accuracy and monitor your credit health.