Interest rate predictions trends: what to expect

Interest rate predictions significantly influence personal finances by affecting borrowing costs, savings returns, and investment strategies, making it essential to stay informed and adjust financial plans accordingly.

Interest rate predictions trends play a crucial role in financial planning. As rates fluctuate, how do these changes affect your wallet? Let’s uncover the patterns that shape our economy.

Understanding interest rate trends

Understanding interest rate trends is essential for making informed financial decisions. As interest rates fluctuate, individuals and businesses must adapt to ensure their financial health. In this section, we will explore some key aspects of these trends and their implications.

The Basics of Interest Rates

Interest rates represent the cost of borrowing money or the return on savings. They are influenced by various factors, including economic growth, inflation, and central bank policies. Knowing how these components work together can help you navigate financial choices.

Factors Affecting Interest Rates

Several elements impact the direction of interest rates:

- Central bank decisions: Banks like the Federal Reserve influence rates through monetary policy.

- Inflation: Rising prices lead to higher rates to maintain purchasing power.

- Economic growth: Strong growth often pushes rates up, while slumps may lead to lower rates.

- Global events: International issues can create uncertainty, impacting rates.

Understanding how these factors interact provides clarity when assessing interest rate predictions. For example, when inflation rises, central banks typically react by increasing rates to combat it. Conversely, during economic downturns, they may lower rates to encourage spending.

How to Analyze Interest Rate Trends

Monitoring interest rate trends involves analyzing various data points and indicators. Key metrics include:

- The federal funds rate: This is the rate at which banks lend to each other overnight.

- Mortgage rates: These rates affect home purchasing rates and housing market dynamics.

- Consumer lending rates: Understanding these rates can help evaluate costs for borrowing.

By closely observing these data points, individuals can make informed decisions regarding loans, mortgages, and investments. Ultimately, grasping the significance of interest rate trends allows for better financial planning and risk management.

Factors influencing interest rate predictions

Factors influencing interest rate predictions are vital for understanding how economic changes affect borrowing and saving. Various elements, both domestic and international, play significant roles in shaping these predictions.

Economic Indicators

Several key economic indicators serve as predictors when assessing future interest rates:

- Inflation rates: Higher inflation can lead to increased interest rates as lenders seek to maintain profit margins.

- Employment rates: When jobs are plentiful, spending increases, which can push rates upward.

- Consumer confidence: A positive outlook can lead to increased spending, influencing rates.

Tracking these indicators helps gauge the direction of interest rates. For instance, if inflation rises consistently, central banks typically respond by increasing rates to control spending.

Central Bank Policies

The decisions made by central banks, like the Federal Reserve, significantly influence interest rates. They use tools such as:

- Adjusting the federal funds rate: Lowering this rate can stimulate the economy.

- Open market operations: Buying or selling government securities affects money supply.

- Reserve requirements: Changing how much banks must hold in reserve impacts lending capacity.

Central banks aim to balance stimulation of the economy with the need to control inflation. Their policies are crucial in shaping interest rate predictions as they respond to economic data.

Global Economic Events

International events can also create significant fluctuations in interest rate predictions. Global crises or economic agreements can shift market dynamics. For example, a trade war might lead to higher rates as investors seek safety in stable returns. Conversely, positive international agreements can encourage lower rates by boosting global markets.

Understanding these factors helps individuals and businesses make informed financial decisions. By analyzing the influences behind interest rate predictions, you can better navigate the complexities of the financial landscape.

How to prepare for changing rates

Knowing how to prepare for changing rates is crucial for anyone looking to manage their finances wisely. When interest rates shift, they can have a direct impact on loans, mortgages, and investments.

Review Your Financial Situation

The first step involves a thorough review of your current financial situation. Understand the types of loans you have, including:

- Fixed-rate loans: These loans maintain the same interest rate throughout the term.

- Variable-rate loans: These loans can change based on market rates.

- Mortgages: Know whether your mortgage is fixed or adjustable.

Evaluating these elements helps you prepare for how rate changes may affect your finances. If you have variable-rate loans, rising rates could increase your payments significantly.

Consider Refinancing Options

When rates drop, refinancing your loans can be a smart move. Lower rates mean potentially lower monthly payments. Here are some points to consider:

- Cost of refinancing: Ensure the savings outweigh the fees.

- Loan term: Decide if you want a shorter or longer loan term.

- Current rates: Keep an eye on the market to time your refinancing wisely.

Refinancing can be advantageous but should align with your financial goals.

Adjust Your Budget

Another important step is to adjust your budget according to anticipated interest rate changes. When rates rise, it may be necessary to allocate more funds for loan payments or credit expenses. On the flip side, lower rates might provide extra room in your budget for savings or investments.

Ultimately, staying informed about market trends is vital for adapting your strategy and achieving financial stability. Staying proactive will help you navigate the effects of changing rates with confidence.

The impact of interest rates on your finances

The impact of interest rates on your finances is significant and can influence various aspects of your financial health. Understanding this impact helps you make informed decisions about borrowing, saving, and investing.

Effects on Borrowing Costs

When interest rates rise, the cost of borrowing increases. This means that loans for cars, homes, and personal expenses become more expensive. For those with variable-rate loans, monthly payments can rise sharply. Here are key effects to consider:

- Higher monthly payments can strain budgets.

- Less disposable income may lead to reduced spending.

- People may choose to delay or forego major purchases.

Conversely, when interest rates fall, borrowing becomes cheaper. Individuals may find it easier to take out loans or mortgages, potentially boosting economic activity.

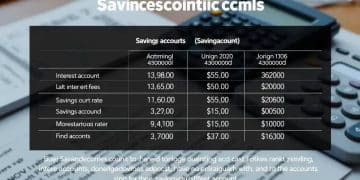

Impact on Savings

Interest rates also affect the returns on savings accounts and investments. Higher rates generally lead to better returns on savings, encouraging individuals to save more. On the other hand, lower rates can result in decreased interest earnings. Here are some effects:

- Savings accounts yield higher interest, rewarding savers.

- Investments in bonds and fixed-income products become more attractive.

- People may shift investment strategies based on rate changes.

Having a solid understanding of these dynamics enables better financial planning and decision-making. As rates fluctuate, it is essential to reassess savings plans and investment strategies regularly to maximize returns.

Influence on Investments

The stock market is sensitive to interest rate changes. When rates rise, borrowing costs for companies increase, potentially lowering profits and stock prices. Conversely, lower rates can stimulate corporate investment and drive stock prices up. Monitoring interest rates allows investors to anticipate market movements and adjust portfolios accordingly.

In summary, the impact of interest rates on your finances is far-reaching. From borrowing costs to savings and investments, understanding these effects can help you navigate the financial landscape more effectively.

FAQ – Frequently Asked Questions about Interest Rates and Personal Finances

How do interest rates affect my loans?

Interest rates influence the cost of borrowing; higher rates mean higher monthly payments on loans like mortgages and car loans.

What impact do interest rates have on my savings?

Higher interest rates typically lead to better returns on savings accounts, encouraging you to save more.

How can I prepare for changing interest rates?

Review your financial situation, consider refinancing loans, and adjust your budget to accommodate potential fluctuations.

What should I know about investing during interest rate changes?

Interest rates can impact the stock market, so it’s important to stay informed and adjust your investment strategy accordingly.